Follow International Logistics of Beef From Australia to Usa

In an increasingly competitive world, Commonwealth of australia has some innate advantages in delivering high quality red meat protein to global markets: information technology is in the right neighbourhood to access growing need in the Asia Pacific and earth-leading shelf-life performance underpins an expanding chilled trade.

As such, Commonwealth of australia is the second largest exporter of chilled beefiness (the US is number 1 but is advantaged past its land border with Canada and Mexico) and the biggest exporter of chilled sheepmeat.

However, global shipping and air-freight have been in turmoil over the concluding year. Consumer demand for goods has vastly exceeded expectations, most notably in the US, and supply bondage accept grappled with relentless disruptions from COVID-19. With relatively inelastic global shipping capacity, container shortages have been exacerbated, freight rates have skyrocketed (particularly on Asia-US and Asia-Europe routes but also ex-Australia) and bottlenecks accept emerged at major ports beyond the world.

This stretched aircraft environment has been thrown farther into disarray as central international ports and their surrounding freight networks take gone into lockdown following COVID-19 outbreaks, such equally at Yantian Port and, more recently, at Ningbo Port in China. Other sources of disruption have derailed supply bondage, such as the blockage of the Suez Canal or industrial action at Port Botany in Australia.

Meanwhile, air-freight has offered little reprieve from such pressures, with passenger planes – which carry the bulk of transnational air cargo – grounded and international flights deterred past caps on passengers permitted to enter Commonwealth of australia.

While exporters in North America, South America, New Zealand and Europe take faced these same challenges, disruption has proved particularly testing and plush for Commonwealth of australia's chilled red meat merchandise. Australian cherry meat exports declined in 2020–21 due to the recovery in the herd and flock and associated shortfall in slaughter-ready livestock – simply tight supplies have been compounded by persistent freight disruption.

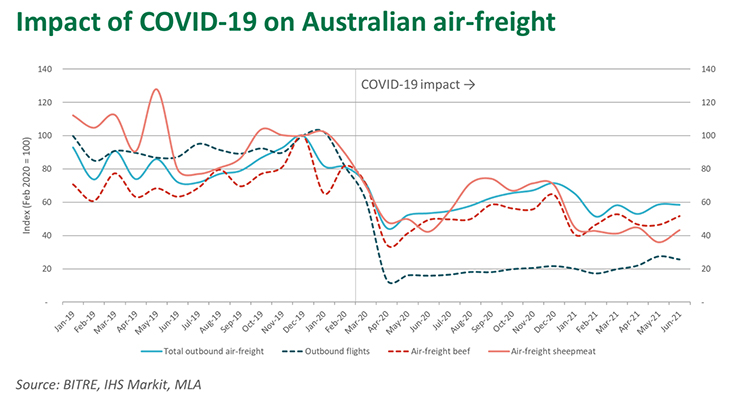

Air-freight chapters crisis

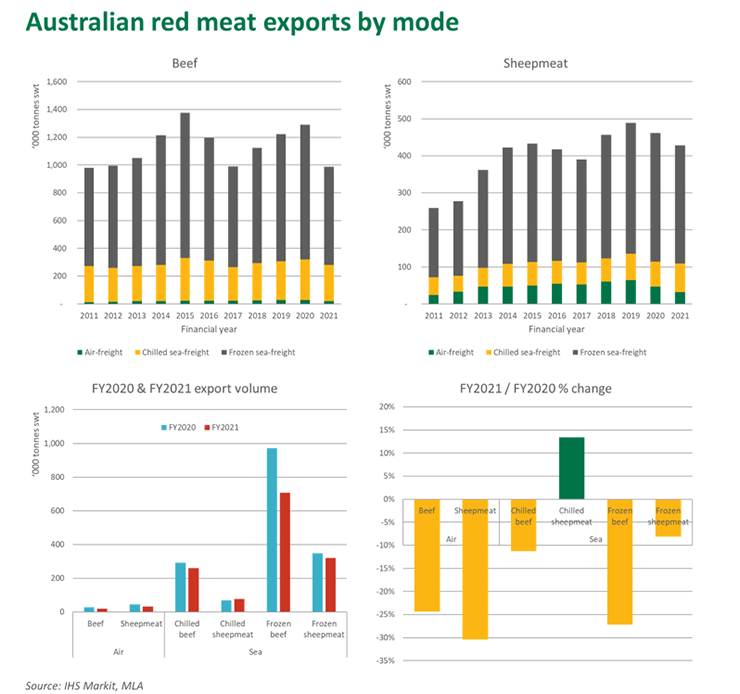

Air-freight shipments were the commencement to feel the impact of COVID-19 every bit passenger flights collapsed. In 2019 (pre-COVID-19), air-freight accounted for 2% of beef exports (8% of chilled beefiness) and 12% of sheepmeat exports (45% of chilled sheepmeat). Some products and markets, notably chilled lamb carcases into the Middle Due east, accept traditionally been far more than reliant on air-freight, as discussed previously .

The total volume of all Australian outbound air-freight in 2020–21 declined past 19%, but beefiness and sheepmeat were more exposed, falling 24% and thirty% year-on-year, respectively, as seen in the above nautical chart. Despite support from the Australian Government's International Freight Assistance Mechanism (IFAM), the sheer lack of planes in the heaven has hit blood-red meat exports to sure markets peculiarly hard.

- Of Commonwealth of australia's superlative 5 air-freight sheepmeat markets (Qatar, UAE, State of kuwait, Hashemite kingdom of jordan and Bahrain) in the v years prior to COVID-19, all recorded double-digit falls year-on-year in 2020–21 air-freight volumes. Qatar was least affected, back 20%, and Bahrain was worst off, back 99%.

- Of Australia's top-five air-freight beef markets (Singapore, Hong Kong, Red china, Thailand and Korea), the results were more than mixed. Hong Kong managed to expand in 2020–21, up 14%, while the others recorded substantial falls, with consignments to China collapsing 67% year-on-year.

Despite contempo improvements in Middle Due east shelf-life requirements for imported vacuum-packed chilled beef and sheepmeat primals, this has not facilitated an firsthand switch from air to sea-freight into the region for two reasons:

- The gain in marketing time created by these changes has been consumed by delayed shipping schedules.

- The bulk of chilled sheepmeat trade has traditionally been in carcase form.

Of the top-five air-freight sheepmeat markets, chilled exports across both modes take still declined by double digits (compared to 4% across all markets).

Interestingly, overall chilled sheepmeat sea-freight exports managed to expand xiii% in 2020–21, but this has been driven by markets that already relied upon the style, particularly the US. Chilled sea-freight sheepmeat shipments to the US were upward an impressive 33% last fiscal year to a record twoscore,900 tonnes swt, bolstered by potent sales of legs through retail and a recovery in foodservice loin demand. While this is positive, the lost merchandise into the Middle East and the erosion of market share will need to be clawed back from proximate competitors and other proteins that take filled gaps in the meantime.

Relentless shipping disruption and reefer shortages

The uptick in chilled sea-freight sheepmeat does not reflect the major challenges faced by exporters in accessing global markets. Furthermore, while sea-freight product may depart Australia as chilled, it may demand to be frozen down at substantial loss of premium once landing in market due to delays in shipping and clearing community. Meanwhile, chilled sea-freight beef exports declined by 11% in 2020–21, while frozen body of water-freight beef plunged 27%.

Commonwealth of australia is not lone in the challenges it is facing. US lawmakers are seeking to bolster the power of the Federal Maritime Commission (FMC) to ensure detention or demurrage charges are practical fairly and to hogtie carriers calling at US ports to have exports. The ability to coerce the global aircraft alliances and resolve freight disruption via domestic regulation remains unclear – regulation is unlikely to address the fundamentals of limited brusque-term capacity, surging goods demand in rich countries and ongoing disorder from COVID-19 outbreaks.

While unilateral action by the United states of america may alleviate some of its pressures, it could compound freight problems elsewhere as carriers reposition reefer and dry goods containers to the US over other origins, such as Australia. Dissimilar the Us, Australia does not have the economic and trade weight to compel carriers to change their behaviour – enforcing greater rules may simply hateful they cease calling, especially when record profits can be made elsewhere.

In the concurrently, as ocean-freight rates have sky-rocketed and equipment has become scarce, some reefer containers have been converted to dry boxes and repositioned to more lucrative ex-Asia routes, reducing the supply returning to Australia and calculation farther force per unit area to red meat exporters.

Moreover, Australian exporters will demand to continue navigating disruption from the COVID-19 Delta strain in a turbulent global surround. The temporary shutdown of Yantian Port, which triggered container congestion at other major Chinese coastal ports, was followed by a smaller shutdown in Ningbo Port, and similar disruption is evident across key ports in Southward-East Asia, most recently in Ho Chi Minh City.

Some sources of consolation

COVID-19 remains the primary cause of ongoing turmoil to global freight. Getting COVID-19 cases nether control and returning to some level of normality will be the most effective solution to the current disruption – still, the timing and degree of that happening remains unclear.

Equally the aphorism goes, the other cure for high prices is high prices. Bolstered past the most profitable twelve months on record, major carriers announced to be responding to prices signals and adding chapters via new ship orders that will come up online in the next few years, equally well as increased purchases of dry and reefer containers.

Australia could also accept steps to accost the performance of key ports: The World Bank / IHS Markit Container Port Performance Alphabetize 2020 and Australian Chamber of Commerce and Industry National Trade Survey pigment a fairly bleak picture of the ease of moving goods into and out of the country. Industrial action in Melbourne, Sydney and Brisbane in 2020 and 2021 has added a further layer of doubt for Australian exporters.

The near vulnerable product to air-freight capacity is the lamb carcase trade to the Eye East. While the gains on shelf-life requirements may come across some end-users switch across to vacuum-packed chilled primals, a preference for carcases, peculiarly through retail, will probable remain in the immediate future. Culling packaging and freight solutions may be required to shift a greater portion of this carcase trade away from planes and onto ships. In the meantime, the Australian Authorities appear last week it would extend IFAM programme through to July 2022, supporting industry to sustain trade relationships with key customers in the Heart East and elsewhere.

The digitisation of merchandise documentation and adoption of electronic health certificates should remove some unnecessary costs and delays to exporting Australian red meat. The Section of Agriculture, Water and the Environment is trialling electronic wellness certificates in a range of markets, while other importing countries have likewise adopted digital solutions for receiving documents. The removal of unnecessary documentation legalisation required in some markets could too reduce delays and expand the window to market chilled product.

Other longer-term solutions to freight disruption could lie in greater inter-modal and transhipment flexibility. For instance, Singapore has been trying to position itself as a nutrient re-consign hub for South-East asia, leveraging its connectivity and proximity to markets. However, to date, solutions that maintain the integrity of the Australian health certificate beyond jurisdictions and offering commercial flexibility have yet to be determined.

Source: https://www.mla.com.au/news-and-events/industry-news/freight-turmoil-hitting-red-meat-exports/

0 Response to "Follow International Logistics of Beef From Australia to Usa"

Post a Comment